Mining Investment Trends: Opportunities and Challenges in 2024

The mining sector is experiencing a dynamic shift as we move into 2024, with evolving economic conditions, technological advancements, and changing regulatory landscapes creating both opportunities and challenges for investors. This comprehensive analysis explores the key trends shaping mining investments, from global economic impacts and sustainable practices to the specific context of Iran's rich mineral potential. By understanding these factors, investors can strategically navigate the complexities of the mining industry, capitalizing on emerging opportunities while mitigating associated risks.

Navigating the Global Economic Landscape

The mining sector is intricately linked to the global economy, with fluctuations in economic conditions significantly impacting investment trends. In 2024, the sector is poised to navigate a complex landscape characterized by economic recovery from recent global disruptions, varying growth rates across regions, and evolving trade policies. Investors must stay informed about macroeconomic indicators, such as GDP growth rates, inflation, and currency stability, to make informed decisions.

Key Drivers of Investment in the Mining Sector

Several key drivers are shaping investment in the mining industry. Technological advancements, particularly in automation and artificial intelligence, are enhancing operational efficiencies and reducing costs. Additionally, the increasing demand for minerals used in renewable energy technologies, such as lithium and cobalt, is driving investments. Environmental, social, and governance (ESG) criteria are also becoming critical in investment decisions, with investors favoring companies that demonstrate strong sustainability practices.

Emerging Markets: Spotlight on Iran

Emerging markets are offering new investment opportunities, with Iran standing out due to its rich mineral resources. Iran's mining sector is diverse, encompassing a wide range of minerals, including iron ore, copper, lead, zinc, and rare earth elements. Despite facing challenges such as international sanctions and regulatory complexities, Iran's mining industry holds significant potential for growth and development, attracting investors looking to capitalize on untapped resources.

Technological Innovations Shaping the Future of Mining

Technological innovation is at the forefront of transforming the mining sector. Automation and AI are revolutionizing mining operations, leading to safer and more efficient extraction processes. The use of drones for surveying and monitoring, blockchain for supply chain transparency, and advanced data analytics for predictive maintenance are just a few examples of how technology is driving the sector forward. Investors are increasingly looking at companies that are leveraging these technologies to gain a competitive edge.

Sustainable Mining Practices and Their Impact on Investment

Sustainability is no longer a buzzword but a fundamental aspect of mining operations. Investors are prioritizing companies that adhere to sustainable practices, such as minimizing environmental impact, ensuring worker safety, and engaging with local communities. Sustainable mining not only enhances a company's reputation but also mitigates risks and ensures long-term profitability. In 2024, investment flows are expected to favor companies with robust ESG frameworks.

Regulatory Changes and Their Implications for Investors

Regulatory environments are evolving, with governments worldwide implementing stricter regulations to ensure responsible mining practices. Compliance with these regulations is critical for securing permits and maintaining operational continuity. Investors need to stay abreast of regulatory changes and assess their implications on project timelines, costs, and profitability. Countries with clear and stable regulatory frameworks are likely to attract more investment.

The Role of Geopolitical Factors in Mining Investments

Geopolitical factors play a significant role in shaping mining investment trends. Political stability, diplomatic relations, and trade agreements can influence investor confidence and determine the feasibility of mining projects. Geopolitical tensions and conflicts can disrupt supply chains and create uncertainties, while favorable diplomatic ties can facilitate smoother operations and market access. Investors must consider geopolitical risks when evaluating potential investments.

Investment Strategies for Maximizing Returns

Developing effective investment strategies is crucial for maximizing returns in the mining sector. Diversification, risk assessment, and strategic partnerships are key components of successful investment strategies. Investors should diversify their portfolios across different minerals and geographic regions to mitigate risks. Conducting thorough due diligence and engaging with experienced local partners can also enhance investment outcomes.

Challenges in Resource Exploration and Development

Resource exploration and development come with inherent challenges, including technical, environmental, and social issues. Geological complexities, regulatory hurdles, and community opposition can delay projects and increase costs. Investors need to conduct comprehensive feasibility studies and engage with stakeholders early in the project lifecycle to address these challenges effectively.

Case Studies: Successful Mining Investments in 2023

Examining successful mining investments from the previous year can provide valuable insights for future investments. Case studies of companies that have navigated challenges, leveraged technological innovations, and implemented sustainable practices can serve as models for success. Learning from these examples can help investors identify best practices and avoid common pitfalls.

Risk Management in Mining Investments

Risk management is a critical aspect of mining investments. Identifying and mitigating risks related to market volatility, operational challenges, regulatory changes, and environmental factors is essential for protecting investments. Investors should develop robust risk management frameworks that include regular monitoring, contingency planning, and insurance coverage.

The Influence of Commodity Prices on Investment Decisions

Commodity prices have a direct impact on the profitability of mining projects. Fluctuations in prices can influence investment decisions, with higher prices generally leading to increased investment activity. Investors need to monitor market trends and price forecasts for key commodities to make informed decisions. Hedging strategies can also help mitigate the impact of price volatility.

Future Trends: What Investors Need to Know

Staying ahead of future trends is vital for successful mining investments. Emerging trends such as the growing demand for battery minerals, advancements in mining technology, and the increasing importance of ESG factors will shape the sector in the coming years. Investors should continuously research and adapt to these trends to capitalize on new opportunities.

Leveraging Data and Analytics for Smarter Investments

Data and analytics are becoming increasingly important in the mining industry. Advanced data analytics can provide insights into operational efficiency, resource potential, and market trends. Investors can leverage data-driven approaches to make more informed investment decisions, optimize resource allocation, and enhance project performance.

The Impact of Climate Change Policies on Mining Investment

Climate change policies are reshaping the mining industry, with stricter regulations and increased scrutiny on carbon emissions. Investors need to consider the impact of these policies on mining operations and investment viability. Companies that adopt low-carbon technologies and practices are likely to attract more investment and benefit from regulatory incentives.

WE ARE KIMIA

Kimia Holding stands as a diversified conglomerate with a strong foothold in various sectors including mining and mineral resources, tourism services, livestock and poultry, agriculture, and foreign trade foreign trade in Iran and across the Middle East. However, it is within the realm of mining that Kimia Holding has truly distinguished itself, garnering recognition for its unwavering commitment to excellence and innovation.

CONTACT KIMIA

Our experts at Kimia Holding eagerly await your inquiries and are prepared to provide insightful answers or address any questions you may have. Should you require further details or wish to share your opinions, please don't hesitate to reach out. Your engagement is valuable to us.

Iran is endowed with abundant mineral resources, including significant deposits of iron ore, copper, lead, zinc, and rare earth elements. The country's diverse geology offers vast potential for exploration and development, making it an attractive destination for mining investments. Despite the challenges posed by international sanctions and regulatory complexities, Iran's mining sector remains a promising frontier for investors.

Mining Investment Trends in Iran: Opportunities and Challenges in 2024

Conclusion

As we advance into 2024, the mining sector is poised at the intersection of significant technological, economic, and regulatory transformations. Investors who stay informed about these evolving trends, particularly the integration of sustainable practices and advanced technologies, will be better positioned to capitalize on new opportunities. Iran's rich mineral resources and growing technological adoption present a unique investment landscape, albeit with its own set of challenges. By leveraging strategic insights, engaging in thorough risk management, and prioritizing sustainability, investors can navigate the complexities of the mining industry and achieve robust returns.

Resources

Iran's Rich Mineral Resources

Iran's mining industry is increasingly adopting technological advancements to enhance efficiency and productivity. The use of automation, AI, and advanced geological survey techniques is becoming more prevalent. These innovations are helping to overcome technical challenges and optimize resource extraction. Investors should look for opportunities to support and leverage these technological developments.

Technological Advancements in Iran's Mining Industry

Engaging with local communities and ensuring social responsibility are crucial aspects of mining projects in Iran. Building strong relationships with local stakeholders, addressing community concerns, and contributing to social development can enhance the sustainability and acceptance of mining operations. Investors should prioritize projects that demonstrate a commitment to social responsibility and community engagement.

Community Engagement and Social Responsibility

Examining successful mining projects in Iran can provide valuable insights into best practices and strategies for navigating challenges. Case studies of companies that have effectively managed regulatory compliance, community relations, and technological integration can serve as models for future investments. Learning from these examples can help investors identify opportunities and mitigate risks.

Case Studies: Successful Mining Projects in Iran

Iran's mining sector offers significant opportunities in renewable energy minerals, such as lithium and rare earth elements. The global shift towards renewable energy technologies is driving demand for these minerals, creating new investment prospects. Investors can capitalize on Iran's rich mineral resources to support the global transition to a low-carbon economy.

Opportunities in Renewable Energy Minerals

The future outlook for mining investments in Iran is promising, with potential for growth driven by technological advancements, regulatory reforms, and increasing demand for minerals. Investors should adopt a strategic approach, focusing on due diligence, risk management, and sustainable practices. Collaborating with local partners and staying informed about geopolitical developments will also be crucial for success.

Future Outlook and Strategic Recommendations

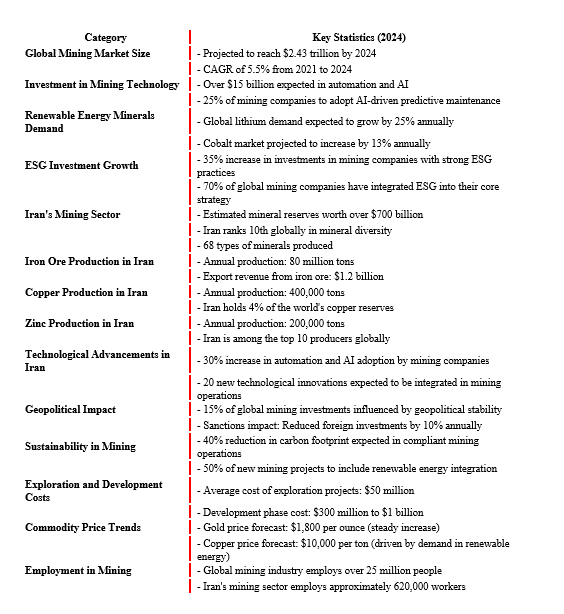

This table provides a detailed snapshot of the current and projected state of the mining sector, offering valuable insights for investors.

Written by RKS Company (RKSC)

a subsidiary of Kimia Holding, which is an International Trade company specializing in facilitating manufacturers with exporting and supplying goods and materials under optimal conditions. As we delve into the dynamic landscape of mining investments in 2024, we explore emerging opportunities, technological advancements, and regulatory challenges shaping the industry's future.