Market Trends and Economic Factors Influencing Iron Concentrate Prices

Introduction to Iron Concentrate Market Dynamics

The iron concentrate market is influenced by a myriad of factors, ranging from global demand and supply trends to technological advancements and geopolitical events. Understanding these dynamics is crucial for stakeholders looking to navigate the complexities of the market.

Geopolitical Influences on Iron Concentrate Market

Global Demand and Supply Trends

Global demand for iron concentrate is primarily driven by the steel industry, which uses it as a key raw material. As construction and manufacturing activities expand, especially in developing economies, the demand for iron concentrate continues to rise. Conversely, supply trends are shaped by the production capacities and export policies of major mining countries.

Impact of Chinese Market on Iron Concentrate Prices

China, as the largest consumer and importer of iron concentrate, plays a pivotal role in setting global prices. Any fluctuations in China's industrial output or changes in its import policies can significantly impact market dynamics. Recent initiatives to reduce environmental pollution and shift towards higher-grade iron ore have further influenced market trends.

Technological Advancements and Their Economic Implications

Technological advancements are transforming the iron concentrate industry, driving efficiency, reducing costs, and reshaping market dynamics:

1.Automation: Automated drilling rigs and haul trucks enhance precision and reduce labor costs, leading to higher productivity and safer working conditions. Companies adopting these technologies can operate more efficiently, translating into lower production costs and competitive pricing for iron concentrate.

2. Data Analytics and Predictive Maintenance: By collecting and analyzing data from equipment and operations, companies can predict equipment failures, optimize maintenance schedules, and minimize downtime. This proactive approach improves operational efficiency and reduces maintenance costs.

3. Advanced Beneficiation Processes: Techniques such as magnetic separation, froth flotation, and gravity separation have become more efficient and environmentally friendly. These improvements enhance the quality and yield of iron concentrate while lowering processing costs.

4. Remote Sensing and Exploration: Satellite imagery, geophysical surveys, and drone technology allow for detailed mapping and analysis of potential mining sites, reducing the time and cost associated with exploration.

5. Blockchain Technology: Enhancing supply chain transparency and traceability, blockchain ensures the authenticity and ethical sourcing of iron concentrate. This transparency can improve market confidence, attract investment, and potentially lead to premium pricing for verified and sustainably sourced products.

6. Energy-Efficient Processing Technologies: Innovations like high-pressure grinding rolls (HPGR) and advanced filtration systems reduce energy consumption and water usage, lowering operational costs and promoting sustainable mining practices.

Regulatory and Environmental Factors

Environmental regulations and sustainability initiatives are becoming increasingly stringent worldwide. Compliance with these regulations can lead to higher operational costs, influencing the prices of iron concentrate. Companies are now investing more in eco-friendly technologies and practices to meet regulatory standards and reduce their environmental footprint.

Geopolitical factors significantly shape the global iron concentrate market:

1. Trade Policies and Tariffs: Countries may impose tariffs on iron ore imports or exports to protect domestic industries, influencing market prices and global supply and demand dynamics.

2. Political Stability and Regulatory Environment: Stable governments with clear and favorable mining regulations attract investment and promote consistent production. Conversely, political instability and regulatory uncertainty deter investment and disrupt production, leading to supply shortages and price increases.

3. Regional Conflicts and Security Issues: Armed conflicts, insurgencies, and geopolitical tensions can halt production, damage infrastructure, and create logistical challenges, leading to supply shortages and increased prices.

4. International Sanctions and Embargoes: Sanctions on iron ore-producing countries can limit their ability to export, reducing global supply and increasing prices. Companies in sanctioned countries may face difficulties in accessing technology, financing, and international markets.

5. Diplomatic Relations and Trade Agreements: Positive diplomatic ties and favorable trade agreements promote cross-border trade, reduce tariffs, and enhance market stability. Conversely, strained diplomatic relations and the absence of trade agreements create barriers, increasing costs and complicating logistics.

6. Global Organizations and International Agreements: Organizations like the World Trade Organization (WTO) influence the market by establishing trade rules, resolving disputes, and promoting cooperation. Compliance with international standards and participation in trade agreements enhance market access and reduce trade barriers.

Fluctuations in Raw Material Costs

The costs of raw materials, such as energy and labor, directly affect the pricing of iron concentrate. Increases in energy prices, for instance, can escalate mining and transportation costs, leading to higher market prices for the final product.

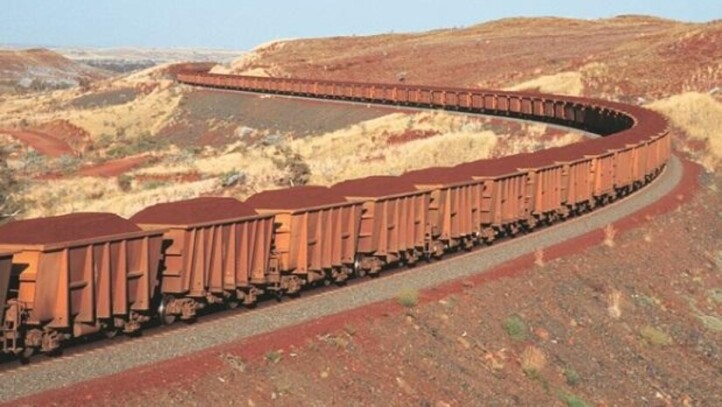

Transportation and Logistics Costs

Efficient transportation and logistics are critical for the iron concentrate market. Costs associated with shipping, handling, and storage can significantly influence the final price. Infrastructure developments, such as new railways and ports, can enhance logistics efficiency and reduce costs.

WE ARE KIMIA

Kimia Holding stands as a diversified conglomerate with a strong foothold in various sectors including mining and mineral resources, tourism services, livestock and poultry, agriculture, and foreign trade foreign trade in Iran and across the Middle East. However, it is within the realm of mining that Kimia Holding has truly distinguished itself, garnering recognition for its unwavering commitment to excellence and innovation.

CONTACT KIMIA

Our experts at Kimia Holding eagerly await your inquiries and are prepared to provide insightful answers or address any questions you may have. Should you require further details or wish to share your opinions, please don't hesitate to reach out. Your engagement is valuable to us.

Seasonal variations and weather conditions can affect mining operations and supply chains. Adverse weather, such as heavy rains or extreme cold, can disrupt production and transportation, leading to supply shortages and price spikes.

Seasonal Variations and Weather Impacts

Resources

Investment Trends and Speculative Activities

Investment trends and speculative activities in the commodities market also play a role in determining iron concentrate prices. Investors' perceptions of market stability and future demand can drive speculative buying or selling, impacting price movements.

The Role of Iran in the Global Iron Concentrate Market

Iran is emerging as a significant player in the global iron concentrate market, thanks to its abundant mineral resources and strategic investments in the mining sector. The country boasts vast iron ore deposits, particularly in regions such as Yazd, Kerman, and Khorasan. Despite challenges like international sanctions and regulatory complexities, Iran continues to enhance its mining capabilities through technological advancements and infrastructure development.

Iran's government has been actively encouraging foreign investments and partnerships to bolster its mining sector. The recent focus on expanding the export of iron concentrate aligns with Iran's broader economic diversification goals. As Iran strengthens its position in the market, its influence on global iron concentrate prices is likely to grow.

Future Outlook for Iron Concentrate Prices

The future outlook for iron concentrate prices remains cautiously optimistic. Continued urbanization and industrialization in developing countries, coupled with technological innovations and sustainable practices, are expected to drive demand. However, potential geopolitical tensions and environmental regulations could introduce uncertainties.

explore our article "Mining Investment Trends: Opportunities and Challenges in 2024" to know more.

Conclusion

The iron concentrate market is shaped by a complex interplay of global demand and supply trends, technological advancements, regulatory factors, and geopolitical influences. Understanding these factors is essential for stakeholders aiming to navigate this dynamic market effectively. As Iran continues to enhance its mining capabilities and contribute to the global supply, its role in the market will become increasingly significant. By staying informed and adapting to evolving market conditions, investors and industry players can capitalize on emerging opportunities while mitigating associated risks.

Written by RKS Company,

a subsidiary of Kimia Holding, which is an International Trade company specializing in facilitating manufacturers with exporting and supplying goods and materials under optimal conditions. As we delve into the dynamic landscape of mining investments in 2024, we explore emerging opportunities, technological advancements, and regulatory challenges shaping the industry's future.